The Structure of the Indian VC Industry: Players, Fund Types, and Career Implications

- Puneet Suri

- 5 days ago

- 5 min read

Updated: 4 days ago

If you are seriously thinking about building a career in venture capital in India - whether you are a 2 - 4 year CA crunching numbers in Big 4 or a mid-size firm, an MBA nearing graduation and wondering if campus placements will open the right doors, a young professional with some startup operating experience under your belt, or a Global Indian returning after years in the US/UK/Canada facing visa uncertainties - then understanding how the Indian VC industry is actually structured becomes the first real step toward making informed moves.

The industry is not a flat, open playground where anyone with a good resume can walk in and get a seat at the table; it is a layered ecosystem with distinct types of players, varying fund sizes that dictate team structures and hiring patterns, and clear focus areas that influence what kind of skills and backgrounds funds value most. And while the headlines talk about billion-dollar funding rounds and unicorn exits, the day-to-day reality for early-career aspirants is shaped far more by these structural realities than by glamour.

As per recent data from Tracxn (updated early 2026), India has over 2,000 active venture capital funds and the country has seen tens of billions of dollars of venture capital investment across tens of thousands of funding rounds over the last decade- but the real decision-making power and most of the meaningful hiring concentrates in a few hundred serious, institutional players. Total startup funding in 2025 settled around $11 billion (as reported by Tracxn's India Tech Annual Funding Report 2025 and TechCrunch's year-end analysis), marking a selective rebound from previous years, with new fund launches exceeding $12 billion in 2025 (Inc42 data) and investors increasingly focusing on quality over quantity - fewer deals, larger checks in proven models, and emphasis on sectors like AI, deeptech, fintech infrastructure, and consumer businesses showing real traction and profitability.

This structure directly impacts your career path: larger funds hire in a more structured way but demand exceptional operator experience or proven sourcing; mid-sized and micro funds offer easier entry points but with leaner teams and relational hiring; and niche specialists reward domain expertise that you can build through deliberate reps.

Let us break it down clearly.

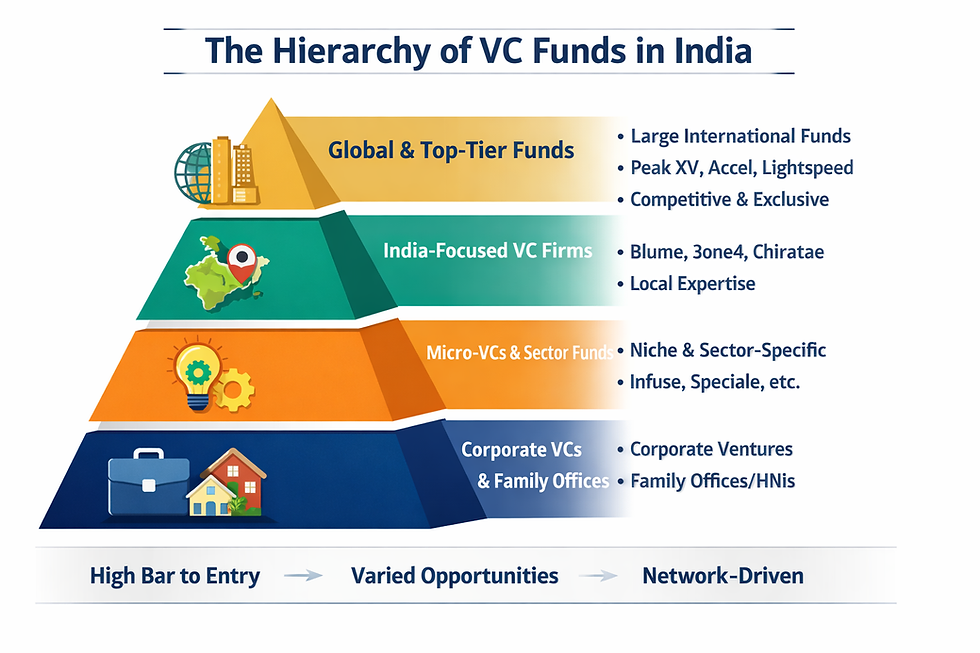

The Main Types of VC Firms

At the top of the pyramid sit the global/international funds with strong India-dedicated arms, such as Peak XV Partners (formerly Sequoia India), Accel India, Lightspeed Venture Partners India, and Tiger Global - these are the ones that manage large India-specific or Asia-focused pools, often with $1–5 billion+ in committed capital for the region, investing across seed to growth stages, and backing some of the biggest names like Zomato, Byju's, Flipkart, and Oyo in the past. They attract massive attention, but their teams remain relatively small (20–50 people across functions), and hiring tends to favor candidates with prior operating roles in high-growth startups, strong sourcing networks, or exceptional diligence track records - which is why many consultants with deal exposure or returning NRIs with global scale experience find openings here if they position themselves correctly.

Then come the homegrown, India-centric funds that have built deep domestic roots over the years, including Blume Ventures, Kae Capital, 3one4 Capital, Chiratae Ventures, and Elevation Capital - typically managing mid-sized funds in the $200 -700 million range, focusing on early-to-growth stages, and often prioritizing local ecosystem understanding, founder empathy, and long-term partnership. These funds are particularly approachable for non-traditional profiles like CAs from regional firms or Tier-2 college graduates who demonstrate sharp judgment through self-built memos or cold founder outreach, as their hiring is more relational and less pedigree-driven compared to the globals.

Further down, you have the micro-VCs and sector specialists, such as Speciale Invest (deeptech), Infuse Ventures (climate), or various $20–150 million funds targeting niche areas like fintech infra, EVs, or SaaS - these operate with very lean teams (often 5 -15 people), making entry possible through internships, or direct cold emails that show genuine sector insight, though the upside in terms of carry and visibility can take longer to materialize.

There are also corporate VCs (Google for Startups, Reliance Ventures, and Brand Capital) and family offices/HNIs that play informally with high-risk tickets - the former offer structured programs for entry, while the latter are almost entirely network-dependent.

Fund Sizes and What They Mean for Your Career Entry

Fund size largely determines team scale, hiring cadence, and the kind of role you might land early on. The largest players with $500 million–$2 billion+ India-focused vehicles run more professionalized operations, often with dedicated analyst/associate tracks often paying ₹18–35 lakh base (plus carry that vests meaningfully after 4–5 years), but they hire sparingly and expect you to have already proven sourcing or diligence experience - think ex-startup operators or those with public memos shared on LinkedIn/Substack.

Mid-sized funds ($100–500 million, like Blume, Kae, Stride) are where most realistic entry happens for aspirants like you - teams of 10–25 people mean more hands-on work from day one, relational hiring through warm intros or standout cold outreach, and a higher chance if you bring diligence experience (CAs excel here) or global operating perspective (returning NRIs shine).

Micro funds (< $100 million) number in the hundreds and can be a stepping stone - smaller teams, easier access via persistence, but limited resources and carry early on.

VC Focus Areas and Sector Trends Shaping Hiring

In the current environment, funds allocate heavily to deeptech/AI (government-backed push), fintech infrastructure, consumer models with profitability, climate/EV, and enterprise SaaS - sectors where application-led businesses get preference over capital-intensive ideas. If you are building experience, aligning your reps (memos, outreach, and fractional roles) to these areas increases your odds significantly, as funds seek candidates who already speak the language of the hot verticals.

Career Implications: How The Structure of VC Industry Affects Your Path

The hierarchy means relational and demonstrated judgment wins over applications - warm intros matter, but sharp cold emails with real insights can open doors in mid/micro funds. For CAs, leverage your due-diligence muscle; for returning Global Indians, highlight global scale; for MBAs/students, use campus or fellowships as bridges. Mid-sized funds often provide the best "realistic" entry - fewer barriers, more impact early. This is why understanding the structure of the Indian VC industry is a critical early step for anyone considering a VC career in India.

The Indian VC industry rewards those who understand its layers and build accordingly - not overnight, but through consistent reps.

For the full realistic guide - How to Build a Venture Capital Career in India: A Realistic Path for Students, Young Professionals, and Global Indians - read it here.

Comments